Beat The TSX Gained 16% In 2024 But Still Couldn’t Beat The Index

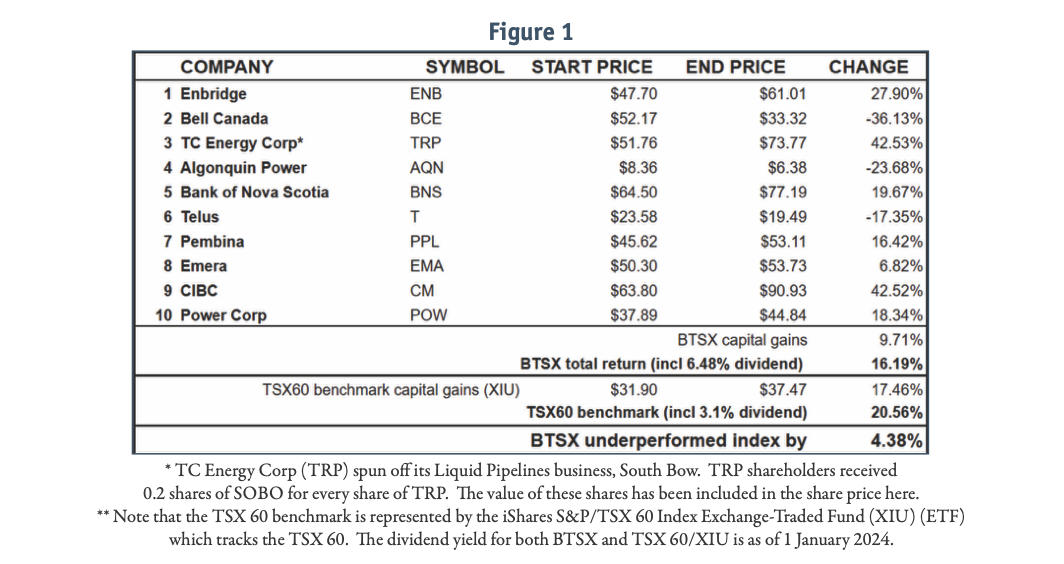

It will likely be no surprise to dividend investors that the Beat the TSX (BTSX) portfolio lagged its benchmark index in 2024. BCE (BCE Inc.), a stalwart dividend stock for decades, has been crushed to prices not seen since 2010. And Algonquin Power & Utilities (AQN) continued the brutal slide it began in 2022, with another dividend cut and accompanying price drop.

Perhaps the real surprise was that BTSX held up as well as it did, marking a 16.19% positive return for the year. Offsetting BCE and AQN, we had two stocks with price gains over 40% and two more with gains of 20-30%—which doesn’t include dividends.

It was a wild year indeed, but before we get into the details of this year’s results, however, let’s review the method and rationale behind Beat the TSX.

Beat The TSX: How It Works

BTSX is a simple method that anyone can use to identify Canadian blue-chip dividend-paying stocks that might be worthy additions to your portfolio. It was created by David Stanley in the 1990s and I’ve been using the method personally since 2008. There are just three steps to the BTSX method:

- List the stocks on the TSX 60 Index by dividend yield.

- Purchase the top 10 yielding stocks in equal dollar amounts.

- Hold for a year and repeat.

The method usually results in a portfolio of stocks with several appealing characteristics:

- They are large and usually stable companies with low volatility.

- They have a high dividend yield.

- Most have a long history of stable and growing dividends.

- They are often purchased when their stock prices are depressed.

Beat the TSX 2024 Results

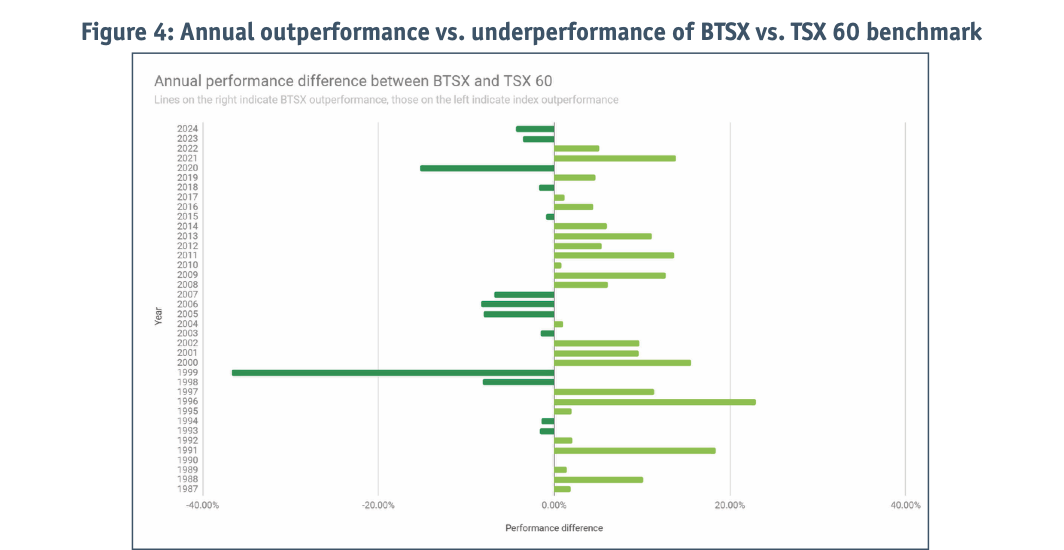

2024 marked the second consecutive year that the BTSX portfolio failed to beat its benchmark, the TSX 60 Index. Every good investment strategy will have periods of underperformance, but this is the first time since 2006/2007 BTSX has done so for two years in a row.

As you can see in Figure 1, the results for individual stocks were all over the place, but at the end of the year, total returns for BTSX were 16.19% vs. 20.56% for the benchmark Index.

Thirty-Six Years Of BTSX Returns

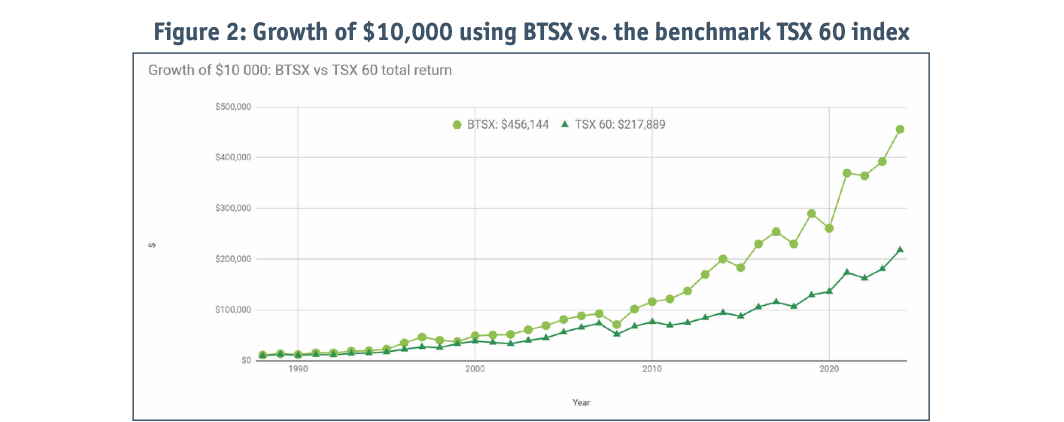

If you’re tempted to dismiss Beat the TSX based on the last two years’ performance, let’s put them in context. When it comes to investing, it’s decades that matter, not years. Since its inception in 1987, BTSX has outperformed the TSX 60 by an average of 2.47 percentage points per year (12.50% vs.10.03%). This means that, if you had invested $10,000 in BTSX stocks 37 years ago, you would now have $456,144—over double what a TSX60 Index investor would have (in both cases total returns re-invested). See Figure 2.

What about periods less than 37 years? Even though Beat the TSX fell behind the Index recently, it has still beaten the benchmark over the last 5-, 10-, 20-, and 30-year periods. How many mutual funds do you know of with a track record like this? See Figure 3.

BTSX: Strengths And Weaknesses

Performance is just one factor that investors must consider. Beat the TSX stocks offer many advantages including:

- They tend to be large, stable, profitable companies.

- They are purchased at attractive valuations.

- They provide high dividend yields.

- They tend to raise their dividends over time.

But BTSX has limitations as well, including:

- The possibility of dividend cuts.

- Suboptimal sector diversification.

- Not all BTSX stocks will be winners.

- The BTSX portfolio doesn’t always beat the benchmark.

If you’re going to use Beat the TSX successfully, you need to be aware of these limitations. Perhaps one of the most important considerations is to ensure BTSX stocks occupy an appropriate place in an otherwise broadly diversified portfolio. Low-cost index funds are great for this.

But that’s not all—you need to stick to your investment plan. Have a plan for dividend cuts and understand there will always be individual stocks, and individual years that will take some of the shine off the method. The only way to benefit from long-term performance is to prepare yourself for temporary underperformance.

Figure 4 will help you understand the ups and downs of BTSX’s performance over time. It shows how BTSX has performed relative to the TSX60 Index year by year: 2024 is at the top and 1987 is at the bottom.

BTSX Dividend Income

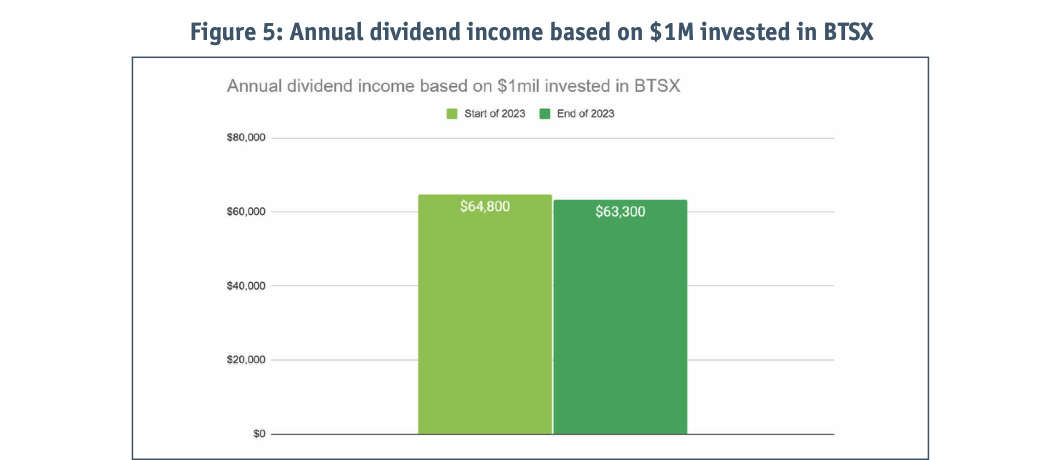

Many investors are attracted to Beat the TSX because of the dividend income. Not only are dividend-paying stocks less volatile than non-dividend-paying stocks, but investing for income helps many investors stick to their plan. Even when markets are down, and the headlines full of doom and gloom, dividend investors are incentivized to hold rather than sell. In fact, as prices fall, reliable dividend-payers get even more attractive because their yields go up.

BTSX started 2024 with an average dividend yield of 6.48%. Except for AQN and TRP, every other BTSX stock either maintained, or raised, its dividend, resulting in an end-of-year yield of 6.33%. What this means in real dollars is that if you had $1M invested in the ten BTSX stocks, your annual dividend income would have gone from $64,800 at the beginning of the year to $63,300 at the end. See Figure 5.

Beat the TSX 2025

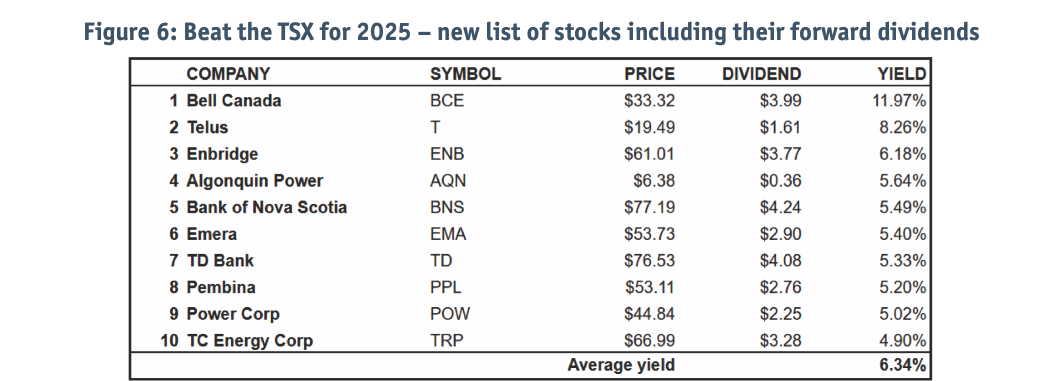

Interested in Beat the TSX for 2025? In Figure 6 is the new list of stocks including their forward dividends.

As always, this list is for information purposes and is not investment advice. You must do your due diligence. Case in point: BCE and AQN are still on the list and may be most at risk of a dividend cut. If you’re not comfortable with these stocks (or any of the others), you can always skip them and select the next highest dividend-payers. You can find the full list of TSX60 stocks in order of dividend yield on my site: DividendStrategy.ca

Wishing you all the best in 2025!

Matt Poyner holds a Certificate in Advanced Financial Advice (CAFA) and provides flat-fee financial planning for Canadian physicians and their families. He can be found at PoynerFinancial.ca. For information about BTSX and DIY investing, go to DividendStrategy.ca