Insights From ETFs: Gaining Exposure to U.S. Healthcare ETFs

The U.S. Healthcare Sector Overview

Historically, the U.S. healthcare industry has been considered a “defensive sector” as it is one of the U.S. economy’s most predictable and resilient sectors. The reasons are quite simple: people need medicines and proper medical treatment whether the economy is prospering or in a recession. Unlike the Canadian healthcare sector, where there are not many publicly traded healthcare companies, the U.S. market is highly dynamic; the industry has created some of the best performers in terms of value creation for shareholders over the years.

There are a few healthcare industry sub-sectors, consisting of biotech, pharmaceuticals, healthcare services, medical equipment (usually referred to as MedTech), and health insurance, among others. Each sub-sector has varied underlying economics in terms of the recurring nature and profitability profile. For example, biotech companies are characterized as highly specialized and speculative for most investors, as the drug approval process is prolonged and uncertain, and only a minority of investors with industry insights and knowledge would be able to invest in this field.

On the other hand, U.S. health insurance is a highly recurring industry since the U.S. is the only developed country without a universal healthcare policy. Therefore, most Americans need to subscribe to private health insurance.

Medical equipment companies have some characteristics of a “consumer staples company” as their products/services are used with a high degree of frequency. U.S. healthcare is also dominated by large global pharmaceutical companies with a portfolio of innovative products and medications that address various medical conditions.

Most investors would consider this sector defensive due to the aforementioned “recession-proof” nature of the business. As a result, healthcare has been considered one of the core exposures of most investors’ portfolios, putting a heavier emphasis on downside protection while capturing good upside potential over time. The overall healthcare sector has a meaningful research and development risk, as the industry depends on intangible assets like patents and brands to operate, and it is quite expensive and risky to develop a new drug or vaccine.

Why Should Investors Revisit The Healthcare Theme Now?

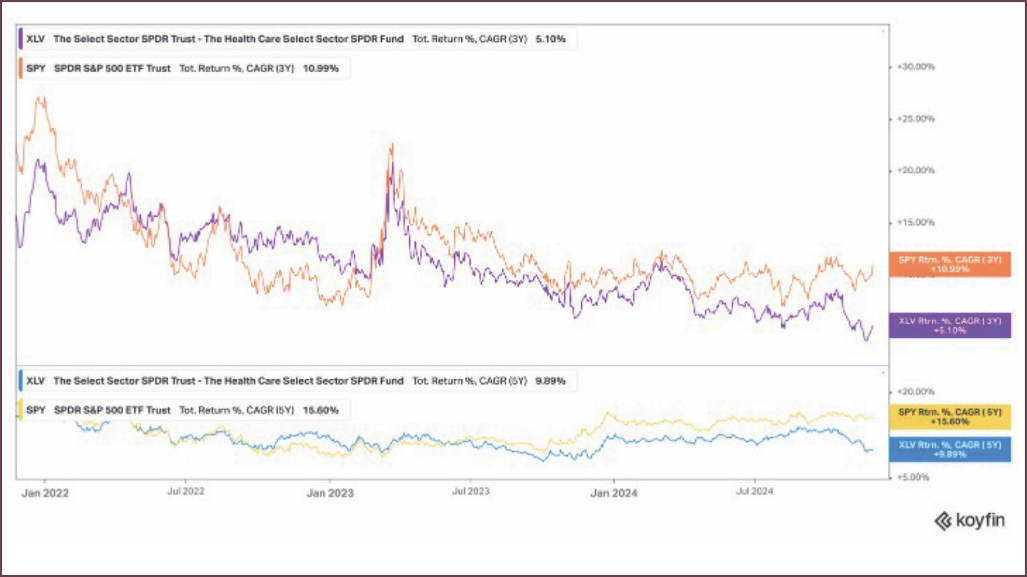

Historically, the overall healthcare sector is considered a high-quality sector, which consistently has provided investors with decent returns over time, with lower volatility compared to most market indices. Over the long term, healthcare has been a consistent outperformer compared to the general market. However, within three-year and five-year timeframes, the healthcare sector has lagged behind the S&P 500 quite meaningfully.

With superior economics of predictable, strong organic growth driven by solid pricing power, the healthcare sector is an above-average industry that should outperform, or be in line with, large market indices. We think the temporary underperformance could offer an attractive entry point for investors to gain additional exposure to the sector here through low-cost Exchange-Traded Funds (ETFs) including:

1. Vanguard Health Care ETF (VHT)

The Vanguard Health Care ETF (VHT) includes some of the largest blue-chip healthcare companies that are based in the U.S. VHT’s investment objective is to track the performance of the U.S. healthcare sector benchmark index by using a full-replication, passively managed strategy.

VHT is a well-established ETF which currently has $17.3 billion in Assets Under Management (AUM), with a twelve-month trailing yield of 1.38%, distributed on a quarterly basis, and a very low Management Expense Ratio (MER) of 0.10%.

VHT’s portfolio has 413 holdings. Some of VHT’s largest positions include Eli Lilly (LLY), one of the largest pharmaceutical companies in the world, UnitedHealth (UNH), the largest health insurer in the U.S., AbbVie, one of the largest biotech companies in the U.S., Johnson & Johnson (JNJ), and Merck & Co. (MRK), another blue-chip pharmaceutical company. The ETF’s sub-sector exposure is concentrated heavily in Pharmaceutical (27.6%), Biotechnology (20.1%) and Healthcare Equipment (19.3%)

2. SPDE S&P Biotech ETF (XBI)

The SPDE S&P Biotech ETF (XBI) is designed to provide investors with a more concentrated exposure to the Biotechnology sector of the Healthcare industry. The fund tracks the return performance of the S&P Biotechnology Select Industry Index. Biotechnology is a speculative field where only a minority group of investors with industry insight could consistently make attractive returns over time. Biotechnology, in general, has contributed meaningfully to society overall, and as a basket, has performed very well against market indices over the long term.

XBI currently has around $7 billion in AUM and charges an MER of 0.35%. Due to its speculative nature, XBI has a broadly well-diversified portfolio with balanced weighting in each name. The top five positions consist of Natera, Inc. (NTRA), Incyte Corporation (INCY), Gilead Sciences (GILD), United Therapeutics Corp (UTHR), and Neurocrine Biosciences (NBIX).

The ETF’s performance over the last five-, and ten-years’ time horizons is around 5.4% and 6.9% annualized, respectively.

3. VanEck Pharmaceutical ETF (PPH)

The VanEck Pharmaceutical ETF (PPH) seeks to replicate the performance of the U.S.-Listed Pharmaceutical 25 Index, which includes some of the most liquid companies in the industry, with decent track records of value creation in terms of dividend growth, and total returns. The weight-loss drug category has been a huge hit for the pharmaceutical industry in recent years and is expected to enjoy a tailwind from broad adoption, and PPH could be a direct way to gain exposure in a concentrated fashion.

PPH has amassed a total AUM of around $607 million, charges an MER of 0.36%, and provides an average dividend yield of 1.9%. The fund’s two largest positions in the portfolio include Eli Lilly and Company (LLY), and Novo Nordisk A/S (NVO), both of which are the primary beneficiaries of the Glucagon-like peptide-1 (GLP-1) weight loss trend over the next few years.

Michael Huyhn, Investment Analyst, 5i Research