The Anatomy of a Big Winner – Core Pillars of a Big Winner

In a prior article, we discussed some common mistakes investors should try to avoid when looking for big winners. A lot of times with investing, “simply” avoiding big mistakes is half the battle. It helps to cut off those left tail risks and bad outcomes and hopefully, at worst, keep mistakes small and easy to recover from. So, by tilting our odds of success away from some common mistakes, we can now look at what we think are common factors to look for when trying to determine if we have found that next big winner.

One important thing to keep in mind here is that these types of names are inherently higher risk. Of course, as we discussed earlier, this does not mean they have to be speculative, but to have the potential of exponential returns there are almost certainly going to be some “hairs” on the stock and company you are looking at. Further, while these are factors that resonate with our approach to investing, they won’t necessarily work or fit with everyone’s approach and style. If it were as simple as just providing a checklist and calling it a day, we would not waste your time and just give you the checklist! So, let’s dive into the first and maybe the most important factor when looking for a big winner.

Momentum:

By definition, to find and hold a big winner, the stock will need to have momentum. For a stock to double, then triple, and so on, it will have to continually be at, or near, not just 52-week highs but all-time highs. Momentum is, by default, a requirement if wanting to find big winners.

Anyone who has listened to Peter Hodson over the years will know that momentum is one of our favourite signals for a stock. And there are a few reasons for this:

- Investors like winning stocks and stocks that “go up” garner more attention and investor interest. For stocks to do well, someone, somewhere needs to care about it!

- Good things happen with higher share prices and market caps. Larger investors can get involved, liquidity improves, valuations go up which allows better access to capital, and so on.

- Stocks trading at 52-week and all-time highs also means someone else is willing to pay more than anyone else has that year (or ever!) and is still expecting a reasonable return from there. If that is not a ringing endorsement, we don’t know what is!

- Most importantly, stocks tend to go up because something “good” is happening at the fundamental level. Earnings or revenues are growing, debt is coming down, contracts are getting signed, or risks are getting solved—whatever it is, at the fundamental level, something good is more than likely happening at the company.

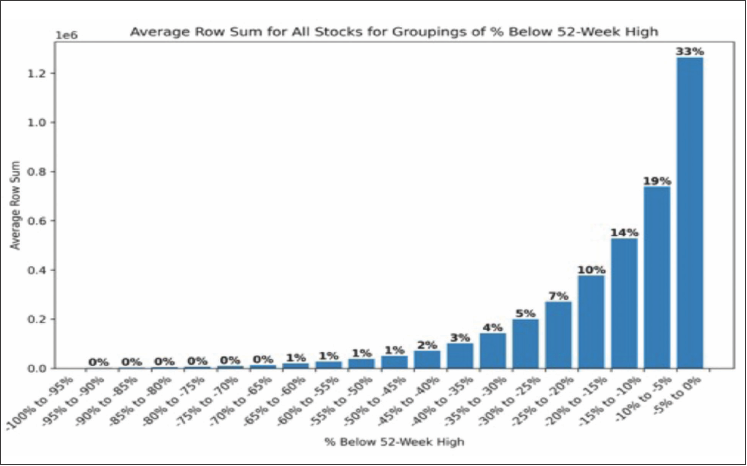

One final reason why momentum is a key factor for big winners is also just more of a general reason why investors, no matter the strategy, need to be momentum investors whether they know it or not. Stocks simply spend most of their time near 52-week highs. The below chart from 5i Research highlights stocks in the S&P 500 going back to 1980 and it shows us that over 50% of the time over that period, stocks traded within 10% of 52-week highs. So, by default, whether looking for a big winner, you probably need to get comfortable with momentum and new highs one way or another!

High Growth and Long Runway for that Growth

We typically consider these two distinct factors, but for the sake of brevity, we will combine these two, as they are intertwined. One company could have explosive growth for a few years and work out well. Another company can have above-average growth (say 10% to 20%) for 10+ years and work out. Regardless of the tempo of the growth and runway, we think these are two key factors when considering a big winner.

On outright growth, it is hard to imagine a stock providing exponential returns if it does not, at least, have the potential for exponential revenue growth. It doesn’t have to happen in a single year, but in most cases, the company will need to be able to grow, and even accelerate, its growth rate on top of already high growth. This growth could be top or bottom line (or both!) but if we had to choose one over the other, we would almost always side with revenue growth. If the basic economics of the business makes sense, for truly fast-growing companies, the earnings will tend to work themselves out over time. One key point on high growth is that we aren’t looking for a single-year explosive growth number. We are looking for high growth in the current environment, but also potential for that growth to continue going forward. This is where “Long Runway” comes into play.

A company needs the ability to grow at not just an outsized rate, but it needs to be able to do it over an outsized period. A long runway could come in many shapes and forms, but here are some key areas in which a company can have a long runway.

Large Market Size: Put simply, a large market that a company can grow into over the long term.

Stealing Market Share: Even better if this is in a large market, to begin with, but a company steadily stealing market share from competitors can have a long runway.

Creating a new market: These scenarios are rarer, but maybe there is some new technology or treatment that is essentially creating a niche or market that did not really exist prior.

Moving into Adjacent Markets: In this scenario, a company may have found a way to make slight adjustments or tweaks (or none) to a product and service that allows it to attack a similar but new market. It might even be a totally new offering that leverages the company’s current base of customers.

Making the pie bigger for everyone: A certain service might be difficult to access in an existing industry. Some companies can innovate, which opens access up to more customers, making the industry larger for everyone’s benefit involved.

A market/sector/theme that is undergoing a big shift: These can come or go, but the most recent example would be the surge in AI-related companies over the last year or two.

Differentiated Model or Approach

If you have a group of companies, all doing the same things at the same time, it is hard to imagine a scenario where one of those vastly outperforms the other. For a company to move in a different manner from the pack, it needs to be doing something differently than the rest. This piece is more “business analysis” as opposed to stock analysis. The most obvious differentiators would be things like noticeable moats, intellectual property, or some sort of technology that others cannot compete with. Often, it is simply a “better mousetrap” than what the competition has to offer.

While the above are all great differentiators, it also does not have to be that technical. Sometimes it could be just a better focus on the customer, and a corporate structure that encourages it. It could be a management team that are strong capital allocators, or some sort of strategy that is just “different” from the competition and leading to success in some form or fashion. As noted, the differentiators are not always obvious and require an investor to understand the company at the business level.

Simple Story

Investors don’t necessarily need to understand the story on “day one”, but the story should be simple enough that other investors can understand it and get behind the thesis as well. If you can’t tell a simple story on why the stock should do well, how could you expect others to understand the company as well? Often, we find that the longer a thesis or presentation on a company is, the less likely it is going to work. It shouldn’t need to take 30 pages to explain to someone why a stock is worth owning. In the context of a name with big winner potential, the opportunity should really be hitting you in the face and be obvious. Just because the opportunity is “obvious” does not necessarily mean it will work out as planned, but they should be facing such a significant opportunity that it is an easy story to tell.

Reasonable Valuation

This part really could be an article on its own as there is so much nuance to valuation, however, there are a few key points to consider when thinking about valuation:

1. Don’t miss the forest for the trees

If you think you have found a company with the potential to double and triple in value, it probably does not make a whole lot of sense to quibble over a perfect entry price that is 5% or 10% lower than it is today. If you are right on the potential, that perfect entry won’t matter much. In fact, while you are waiting for that perfect price, what is likely to happen is that the stock will move higher on you, and then you will be left with a decision to buy at higher prices or wait longer, only to see the stock run away and miss out on the opportunity entirely. To be clear, we are not saying you should be lazy, or throw caution to the wind on valuation, but simply keep the risk versus reward potential in context.

2. Most stocks with big winner potential will look expensive

For better or worse, most names that have the potential to be big winners will look expensive when using traditional valuation metrics. The silver lining here is that it is a good thing! How is that a good thing you ask? It is good because the market is also validating what you are seeing. The market is saying: “Hey, this company has really big potential, that means we are going to pay a premium to have access to the potential returns here”. From here, the hard questions begin as to how much of that opportunity is being priced in and so on, but the fact the market is seeing what you are seeing is not necessarily a bad thing. In fact, some of our biggest losers have been names that we see as having big return potential alongside a cheap valuation. In these cases, the market disagrees with what you are seeing via the cheap valuation. Often, the investor expects the low valuation will also offer downside protection, but if/when it becomes clear the thesis is broken, the low valuation does not offer the protection one might expect. This is not always the case, but if you think you have found a big winner that is also objectively cheap, take a moment to pinch yourself and zoom out to verify the thesis.

3. Traditional valuation metrics are less helpful

Typically, when looking at these types of stocks, using things like a simple price-to-earnings (P/E) ratio or price-to-sales (P/S) ratio are not going to be of much help. These are either looking back a single year or looking forward just one year. However, stocks with this big winner potential are going to be stories that are in terms of years, not months. In turn, it makes sense that a P/E ratio will look a bit nonsensical because it is only capturing earnings one year out, while the opportunity is likely three years out before it starts to be apparent in the fundamentals.

Unfortunately, there is no easy answer to get around this. An investor needs to gain an understanding of what the opportunity might look like in the future, how likely it might be that the company captures it, and what that might look like in terms of revenues and/or earnings.

One final point on the “Reasonable Valuation” piece is that “Reasonable” is a keyword here. As mentioned, it is unlikely these names will look cheap on most simple metrics. It is also not an excuse to totally ignore valuation and throw caution to the wind. Overall, if you fast forward three to five years and look back, will the shares look like a steal today?

A big winner might be rare, but they are not impossible to find and can make a material difference in a portfolio, and in someone’s life, if they are able to find and hold on to them. They are higher risk and often will be more volatile, but if we are able to cut out some common mistakes that we outlined in part 1, and can find some common attributes that these companies might hold, such as those that we have outlined in these pages, we think an investor can be well on their way to finding these names. The final, and maybe most important piece, however, is actually holding on to them! That’s a topic we hope to cover in the next part of this series.

Ryan Modesto, CFA - CEO, i2i Capital Management