How To Use Technical Analysis To Calculate Potential Risk And Return

In this article, I will explain the different types of risks, highlight common investment pitfalls, and discuss actionable ways to navigate market volatility. Whether you’re a seasoned investor or just starting out, this guide should provide valuable lessons on managing risk and making informed financial decisions.

I would like to address a methodology that we at ValueTrend use to examine the upside and downside potential of the markets, and the stocks we may be investing in. This methodology revolves around Technical Analysis, which is the study of trends and crowd behaviour surrounding securities markets. Howard Marks, in his book, The Most Important Thing, tells us that “You can’t predict. You can prepare”. This, I feel, embodies the philosophy of using Technical Analysis in your investment decisions.

There are seven different types of risk. They are:

- Buying incorrectly (timing and price).

- Selling incorrectly (timing and price).

- Black swan events (massive, unexpected drops).

- Missed opportunities.

- Recovery time of a decline.

- Permanent loss of a security.

- Emotional investment decisions (fear, greed).

The Biggest Risk

I think selling incorrectly is the biggest risk of the seven risks noted above. Sure, you can buy incorrectly (at the wrong point) and watch the stock or commodity go down, but so long as it's a quality position, it is likely to recover quickly. Still, if it turns out that the position is not as good a pick as you originally thought it might be, you can limit your risk with a rule-based selling strategy.

If you don’t have a selling strategy for losing positions, you are in trouble. Investors without a logical selling strategy tend to hold on to losing positions and watch them decline further and further— ever increasing their losses. Here’s the truth: Most types of downside risk to your portfolio, apart from black swan events (super parabolic and highly unpredictable moves to the downside), can be limited. That is, risk can be limited if you incorporate a logical sell discipline. Risk in non-guaranteed securities cannot be avoided. But it can be limited.

Missed Opportunities

The most minor form of risk is probably “missed opportunities”. That’s the “woulda-coulda-shoulda” problem. For example, ValueTrend identified Nvidia at the beginning of 2023 as a potential buy, but we didn’t get on it early enough. We missed out on a lot of upside because it moved so quickly. That’s a missed opportunity. But it didn’t cost us any downside, it only caused us to miss out on a slightly better return.

Emotional decisions: Selling and buying at the wrong time

I believe that our emotions are at the epicentre of all types of investment risk, especially when it comes to selling and buying incorrectly. Years ago, I coined an expression (a Keith Richards original!) surrounding using a systematic approach to investing:

“A system will save you from yourself!” - Keith Richards

You are not following a system when you invest without a plan. An investment strategy helps you bypass your emotional urges to become overly enthusiastic and driven by crowd behaviour, or impatient when buying a security. That, or paralyzed with regret while hanging on too long when your security falls. The consequences of not having a systematic approach to buying and selling can be permanent loss. That, or recovery time risk, which is the amount of time it takes to recover your money after a drawdown.

We’ve just discussed the necessity of having a systematic investment plan to avoid the seven types of risk, The rest of this article is dedicated to helping you use stock charts to define and measure the upside potential, and the downside risk of securities before you invest in them. I’ll also offer a few suggestions on how to develop a systematic selling strategy to limit your losses when things go sour. This is a big topic. For a much more detailed explanation of how to systematically employ buy and sell rules for investing, I encourage you to enroll in my very popular online trading course. I feel it is vital for all investors who manage their own portfolios to learn how to develop a rule-based approach to their portfolio management. https://technical-analysis.valuetrend.ca/

Measuring upside potential and downside risk in a consolidating chart pattern

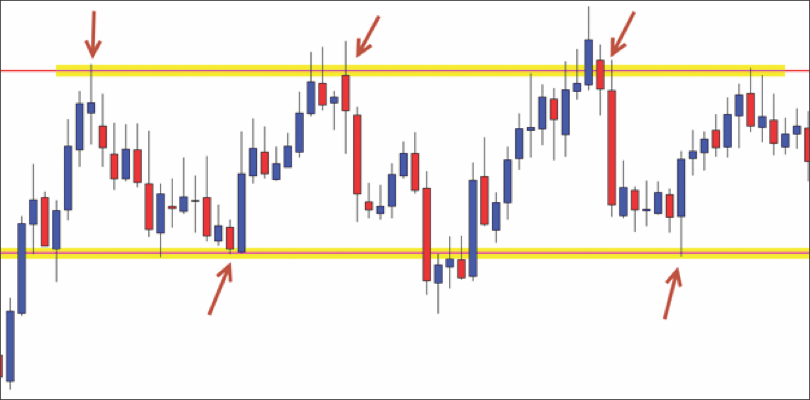

SUPPORT RESISTANCE CHART

Let’s start the next part of our discussion by defining some basic observations:

- Where to buy

- How to measure potential upside

- How to measure potential risk

We’ll start by looking at a chart pattern known as a “consolidation pattern”. A consolidation pattern occurs when the security is moving between a defined range of support (the bottom) and resistance (the top).

The beauty of this pattern is that you know where to buy (near support/bottom), and you know your upside potential (resistance/top). I teach investors some rules on how to identify the potential for the security to break outside of the consolidation pattern in my online trading course. For now, we can keep it simple by saying that we should buy at support and sell at resistance. This is known as “swing trading”.

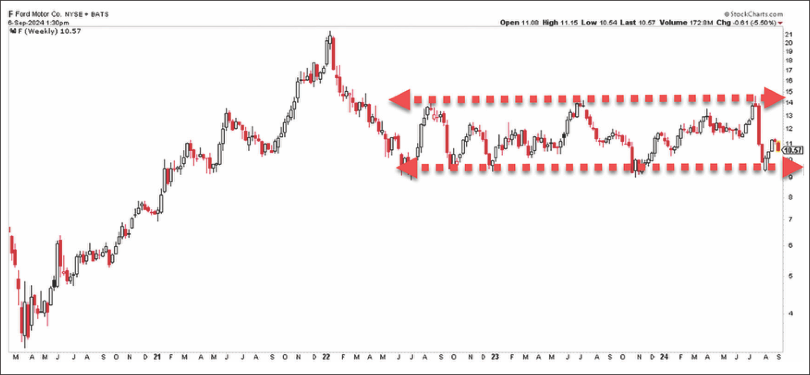

The other nice thing about trading a consolidation pattern is that you also know where to cut your losses if the trade fails. If Ford, in the chart below, breaks support by moving below $9, you sell. My course discusses brief moves below support and how not to get fooled by them. But in the simplest form, with a consolidation pattern, you can identify your “uncle” point of pain that you will accept for this stock before selling. In Ford’s case, we know our stop-loss target as a break below $9 support. How low you will allow it to drift below support must be pre-determined by you before you enter the position. Write it down and stick with your plan!

FORD CHART

Measuring upside potential on a breakout

On the iShares Japan Exchange-Traded Funds (ETF) chart (EWJ-US) below, you can see where stocks have broken past prior points of technical resistance. If you want to make an “educated guess” as to what the security might rise to after a breakout, you can measure the approximate distance between the old lows and the new breakout. Typically, a security will rise to the same level of volatility it had in the last major move before it takes a breather. I’ve marked vertical moves, followed by breakout targets on the EWJ chart to give you an idea of how to measure price targets using the relative symmetry of stock movements.

EWJ CHART

Selling when support breaks

When we look at the EWJ chart, we can also see that this security tends to enter a consolidation after reaching its approximate target. You can “swing trade”, as we saw in the Ford chart above, as that consolidation pattern continues. Or, you can just hold the security, with an eye on selling if the security breaks its support level within the current consolidation pattern.

You can see that if you had sold when the bottom of the 2021 consolidation pattern broke support, you saved lots of grief. The security fell from around $70 to the mid-$40s. It took more than a year just to recover. This is a great example of “recovery time risk”, discussed in my seven types of risk above. To bring things up to the present: Given the consolidation pattern that EWJ is once again stuck in, I would think that a break of recent support near $65 would also be bearish for the security. Note that the security did break $65 back in the summer of 2024, but that didn’t last long. My online course explains how not to get fooled by such spikes. Note that an upside breakout would likely lead to more upside for EWJ. So, now we know our potential buy, sell or breakout points, along with our approximate stop-loss “uncle” point if we are in this security.

Conclusion

This article illustrates just a few of the strategies that you can use to “predict” potential targets for securities. More importantly, it also offers thoughts on how and where to set your sell targets, including stop-loss targets. Again, I do encourage you to enroll in my online trading course noted above for greater detail on trading and developing a buy/sell discipline. By following a systematic process for identifying market risk and upside targets, you will be removing emotion from your decisions. As I have been telling readers of my books and articles for 35 years: “A system will save you from yourself!”

Keith Richards is Chief Portfolio Manager & President of ValueTrend Wealth Mgmt.

He can be contacted at info@valuetrend.ca.

Keith Richards is Chief Portfolio Manager & President of ValueTrend Wealth Mgmt. He can be contacted at info@valuetrend.ca. He may hold positions in the securities mentioned. The information provided is general in nature and does not represent investment advice. It is subject to change without notice and is based on the perspectives and opinions of the writer only. It may also contain projections or other “forward-looking statements”. There is a significant risk that forward-looking statements will not prove to be accurate and actual results, performance, or achievements could differ materially from any future results, performance, or achievements that may be expressed or implied by such forward-looking statements and you will not unduly rely on such forward-looking statements. Every effort has been made to compile this material from reliable sources; however, no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please consult an appropriate professional regarding your particular circumstances.