Cruise Company Stocks: Should You Climb Aboard?

A former job required me to write a travel story about a Caribbean cruise and that’s how I became a passenger on a Disney ship enroute to Castaway Cay, a private island in the Bahamas. My expectations for the cruise were low. The enormous Chihuly glass chandeliers that glistened in the entrance lobby were the first hint that I had vastly underestimated how luxurious an ocean cruise could be. (Disney boasts one crew member for every three passengers on all its vessels.) Whether you love cruises or not, investing in cruise companies may not be such a bad idea.

Earlier this year Royal Caribbean launched the world’s largest cruise ship, Icon of the Seas, from its home port of Miami Harbour. An investor could view the ship’s monumental size and sheer audacity as a ringing endorsement for the future of the international cruise travel industry. The Icon is five times the size of the Titanic, can accommodate more than 7,600 passengers and a crew of 2,350, and offers every type of wholesome diversion including an ice-skating arena, six waterslides, 20 different decks, 40 restaurants, bars and lounges, seven pools, a waterpark, a 55-foot waterfall, Champagne bar, D.I.Y bar crawl, and a $100,000 per week stateroom to escape to when the hyperactive kids, drunken parents, long lineups, and general mayhem are all too much. When the Icon was revealed, it generated the single largest booking day and highest volume booking week in the firm’s history.

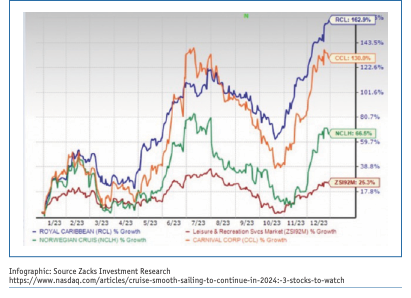

Investors are taking notice. Despite the buzz about Artificial Intelligence (AI) and The Magnificent Seven, cruise stocks had a banner 2023, with triple-digit advances for Royal Caribbean, Carnival and Norwegian up nearly two-thirds. Can the good times continue?

Smooth Sailing

These kinds of vacations are growing in popularity (except for the blip during the pandemic, ahem), among all demographics due to the vast range of amenities and the relatively lower cost compared to land-based holidays. The global cruise market was valued at US$7.67B in 2022 with an expected compound growth rate of 11.5% through 2030.

Cruise lines are investing heavily in their fleets to meet rising demand. Cruise travel is one of the fastest-growing segments in tourism. From a previous high (prior to the pandemic in 2020) of 29.7 million, it is estimated that 39.5 million people will be ocean cruising. What’s driving the growing demand?

For one, there is pent-up demand from travellers who missed cruising during the pandemic. Last year, sales were 15% higher than their 2019 peak. The variety and scale of on-board amenities are hard to resist. The ships are getting bigger and able to accommodate a high number of passengers and there are more ships coming online with capacity growing 19% annually until 2028. To fill this new capacity level, the industry wants to attract a more diverse group. In the past, marketing campaigns for luxury cruises often focused on the Boomer demographic by showing middle-aged, affluent-looking, white, heterosexual couples wearing pastels and sipping champagne as they watched the setting sun.

However, for cruise companies, the new target is the next-gen cruisers composed of Gen-X and Millennials. Of this group, for those who have taken a prior cruise, nearly 90% plan to take more. Among those who have never cruised, more than three-quarters of Millennials say they are considering a cruise vacation, closely followed by Gen-X. To attract a slightly younger demographic and entice repeat cruisers, companies are offering both shorter and longer itineraries.

The cruise industry is also making itself more appealing to the often-neglected solo traveller by building more single-occupancy (“studio”) cabins and special lounges or retrofitting existing ships to accommodate singles. The promotions and marketing are working (too well) with many cruise lines seeing occupancy levels over 100% which occurs when more than two people stay in a cabin. Advance bookings into 2024-25 are exceeding company estimates.

The Magnificent Three

The highest-rated big three cruise companies are Carnival Corp., Royal Caribbean, and Norwegian Cruise Lines; each has numerous brands in their portfolios. Coming off a couple of lean years, the first two names more than doubled their share prices last year while Norwegian gained 70%. Revenues were robust: Norwegian (249.1%); Carnival (173.1%), and Royal Caribbean (172.4%). This was a far cry from the depths of 2020 when each of them fell by double-digits, revenues vaporized, and debt mounted at junk-bond yields to entice nervous creditors.

Despite rising inflation and consumer belt-tightening, the cruise industry has a wide moat. Occupancy has remained resilient during past economic downturns. Folks who love a cruise vacation, really love it, keeping demand sticky. Consequently, cruise companies have been able to raise prices above general costs without losing bookings. The steady cash flow is accelerating debt reduction and bringing them back to profitability.

Choppy Waters

Despite the blue-sky scenario, investing in cruise companies carries unique risks. Cruise companies typically carry high debt loads which can become onerous if revenues drop precipitously, as they did during the pandemic, or when interest rates rise rapidly making it harder to service debt.

Cruise lines have enhanced their safety procedures to prevent or better manage future outbreaks. Yet, despite the lavish amenities, a ship is still a very pretty floating petri dish where infections and diseases spread rapidly.

Growing geopolitical tensions, some of which are being played out at sea, are affecting cruise itineraries. For example, Carnival Cruises was forced to reroute a dozen ships whose itineraries would have taken them through the Red Sea where Iran-backed Houthi rebels are waging war with hijackings, missile and drone attacks.

Cruise ships are major polluters. Heating the pools, cooling the rooms, and keeping all the amenities running 24/7 requires tremendous amounts of energy. According to a recent report, cruise ship emissions are 6% higher than they were before the pandemic. Companies like Royal Caribbean say it scrutinizes its fleet for energy efficiency and emissions. But, given that the cruise industry generates double the amount of total greenhouse gas emissions as flying does, these massive ships are basically a big “FU” to the ozone layer. While holidaymakers remain undeterred, at some point, the cruise industry’s environmental impact may affect business prospects if they are subject to large fines or restrictions.

Shareholders:

Your Ship Has Come In

Many cruise companies offer special perks to shareholders. While these extras should not be a reason to invest, they certainly sweeten the deal for cruise aficionados. These perks include on-board credits, up to $1,000 if you own a minimum of 100 shares, instant upgrades to silver status, branded gifts, late checkouts, and other goodies. To obtain the credit, investors must provide proof of ownership prior to the sailing date.

Rita Silvan, CIM is a finance journalist specializing in women and investing. She is the former editor-in-chief of ELLE Canada and Golden Girl Finance. Rita produces content for leading financial institutions and wealth advisors and has appeared on BNN Bloomberg, CBC Newsworld, and other media outlets. She can be reached at rita@ellesworth.ca.